From Bretton Woods to the Current Crisis: A Long and Winding Road

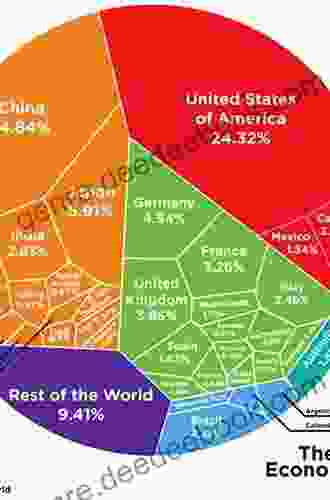

The Bretton Woods system was a system of international economic management established at the Bretton Woods Conference in 1944. The system was designed to prevent the kind of economic chaos that had ensued after World War I. It was based on the principles of fixed exchange rates, the convertibility of currencies into gold, and the creation of the International Monetary Fund (IMF) and the World Bank.

4 out of 5

| Language | : | English |

| File size | : | 611 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 133 pages |

The Bretton Woods System

The Bretton Woods system was a major success in the post-World War II era. It helped to stabilize the global economy and promote economic growth. However, the system began to come under strain in the 1960s as the United States began to run large trade deficits. This led to a loss of confidence in the US dollar and a decline in the value of gold.

In 1971, President Richard Nixon took the United States off the gold standard. This effectively ended the Bretton Woods system and led to a period of floating exchange rates.

The Floating Exchange Rate System

The floating exchange rate system has been in place since 1971. Under this system, the value of currencies is determined by the forces of supply and demand in the foreign exchange market. This system has been more volatile than the Bretton Woods system, but it has also been more flexible.

The floating exchange rate system has been credited with helping to promote economic growth and reduce inflation. However, it has also been blamed for causing financial crises, such as the Asian financial crisis of 1997 and the global financial crisis of 2008.

The Current Crisis

The global financial crisis of 2008 was the most severe economic crisis since the Great Depression. The crisis was caused by a number of factors, including the subprime mortgage crisis, the collapse of the housing bubble, and the failure of several major financial institutions.

The crisis has had a devastating impact on the global economy. It has led to a sharp decline in economic growth, a rise in unemployment, and a loss of confidence in the financial system. The crisis has also raised questions about the future of the international monetary system.

The Future of the International Monetary System

The global financial crisis has led to a number of calls for reform of the international monetary system. Some economists have argued that the floating exchange rate system is too volatile and that it needs to be replaced with a more stable system. Others have argued that the IMF and the World Bank need to be reformed to make them more effective in preventing and resolving financial crises.

The future of the international monetary system is uncertain. However, it is clear that the current system is unsustainable. The global financial crisis has exposed the weaknesses of the floating exchange rate system and the need for reform. The international community must work together to create a new system that is more stable, more just, and more sustainable.

The Bretton Woods system was a major success in the post-World War II era. However, the system began to come under strain in the 1960s and was eventually replaced by the floating exchange rate system in 1971. The floating exchange rate system has been more volatile than the Bretton Woods system, but it has also been more flexible. The global financial crisis of 2008 has exposed the weaknesses of the floating exchange rate system and the need for reform. The international community must work together to create a new system that is more stable, more just, and more sustainable.

4 out of 5

| Language | : | English |

| File size | : | 611 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 133 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Reader

Reader Library

Library E-book

E-book Magazine

Magazine Paragraph

Paragraph Sentence

Sentence Glossary

Glossary Annotation

Annotation Footnote

Footnote Scroll

Scroll Bestseller

Bestseller Library card

Library card Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Thesaurus

Thesaurus Resolution

Resolution Catalog

Catalog Borrowing

Borrowing Stacks

Stacks Archives

Archives Periodicals

Periodicals Scholarly

Scholarly Lending

Lending Journals

Journals Reading Room

Reading Room Rare Books

Rare Books Special Collections

Special Collections Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Thesis

Thesis Storytelling

Storytelling Awards

Awards Book Club

Book Club Textbooks

Textbooks Suzanne Weyn

Suzanne Weyn Laura Chau

Laura Chau Erika Grey

Erika Grey Donna C Hurley

Donna C Hurley Beverly Rosas

Beverly Rosas Michael Ford

Michael Ford Subramanyam Gunda

Subramanyam Gunda Megan Miranda

Megan Miranda Jeb Barnes

Jeb Barnes Tony Hoagland

Tony Hoagland Patrick Takle

Patrick Takle Sandy Carlson

Sandy Carlson Eva Trotzig

Eva Trotzig Shauna L Tominey

Shauna L Tominey Rachel Beyer

Rachel Beyer Joseph R Oxfield

Joseph R Oxfield Jane A G Kise

Jane A G Kise Nicole Helm

Nicole Helm Elena Pankey

Elena Pankey J Albert Mann

J Albert Mann

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Reed MitchellFollow ·16.7k

Reed MitchellFollow ·16.7k Joseph FosterFollow ·8.7k

Joseph FosterFollow ·8.7k Liam WardFollow ·5.9k

Liam WardFollow ·5.9k Jared NelsonFollow ·13.1k

Jared NelsonFollow ·13.1k Warren BellFollow ·18.8k

Warren BellFollow ·18.8k Amir SimmonsFollow ·15.1k

Amir SimmonsFollow ·15.1k Kurt VonnegutFollow ·9.8k

Kurt VonnegutFollow ·9.8k Thomas MannFollow ·10.5k

Thomas MannFollow ·10.5k

Rodney Parker

Rodney ParkerBasics Beginner Guide To Stage Sound

Start with a good source. The...

Glenn Hayes

Glenn HayesKiwi in the Realm of Ra: Exploring the Mystical Kiwi...

Origins and...

John Grisham

John GrishamAdvances In Marine Biology Volume 71

Unveiling the Hidden Wonders...

Edison Mitchell

Edison MitchellGoodbye Brings Hello: Embracing the Transformative Power...

In the tapestry of life, endings...

4 out of 5

| Language | : | English |

| File size | : | 611 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 133 pages |